8th Pay Commission Breaking Update: 2.85 Fitment Factor Could Give 30% Salary Hike from Jan 2026

The anticipation among central government employees is palpable as discussions around the potential 8th Pay Commission Factor gather momentum. With reports suggesting a significant 2.85 fitment factor, employees could be looking at a substantial financial boost.

This breaking update indicates that the next pay revision, potentially implemented from January 2026, might bring an impressive 30% salary hike.

This article delves into the specifics of this projected increase, exploring the role of the 8th Pay Commission fitment factor, its impact on various salary components, and what central government employees can expect from this crucial development. We’ll analyze the latest insights and provide a clear understanding of the proposed changes.

Want ₹36 Lakh in 5 Years? with this National Savings Certificate 2025 Government Guarantee

Understanding the 8th Pay Commission Factor and its Impact

A Pay Commission in India is a body constituted by the Government of India to review and recommend changes to the salary structure, allowances, and other benefits for its central government employees.

These commissions are vital for ensuring that employee remuneration keeps pace with inflation, cost of living, and economic growth, thereby maintaining a fair and competitive compensation package.

The upcoming 8th Pay Commission Factor is expected to be a game-changer for millions of employees and pensioners, marking a significant re-evaluation of their financial entitlements.

The core of any pay commission’s recommendations lies in the ‘fitment factor’. This multiplier is applied to the existing basic pay to arrive at the new basic pay under the revised structure.

For instance, the 7th Pay Commission, implemented in 2016, recommended a fitment factor of 2.57. This meant that an employee’s new basic pay was calculated by multiplying their previous basic pay (under the 6th CPC regime) by 2.57. This mechanism ensures a uniform and proportionate increase across different pay levels, though the absolute increment varies significantly.

The Need For A New Commission Arises Typically Every Ten Years, Driven By Persistent Inflation And The Rising Cost Of Living. Employees Often Find Their Purchasing Power Eroding Over A Decade, Necessitating A Fresh Review Of Their Pay.

Current Discussions Suggest A Robust 8th Pay Commission Fitment Factor Of 2.85, A Notable Jump From The 7th CPC’s 2.57. This Higher Factor Reflects The Accumulated Economic Changes And Aims To Provide A More Substantial Relief And Upliftment For Government Personnel.

As We Move Closer To 2025, The 8th Pay Commission Latest News Today 2025 Indicates This Figure Is A Key Point Of Deliberation, Signaling A Strong Intent To Bolster Employee Welfare.

Want ₹36 Lakh In 5 Years? With This National Savings Certificate 2025 Government Guarantee

Decoding the 2.85 Fitment Factor: A Detailed Salary Hike Projection

The Proposed 2.85 Fitment Factor Is At The Heart Of The Anticipated 8th Pay Commission Factor Salary Revision. To Understand How Much Salary Increase In 8th Pay Commission An Employee Might Experience, It’s Crucial To Break Down The Calculation.

The Fitment Factor Is Typically Applied To The Existing Basic Pay (7th CPC Basic Pay) To Determine The New Basic Pay Under The 8th Pay Commission Regime.

Let’s Consider A Practical Example To Illustrate The Potential Impact:

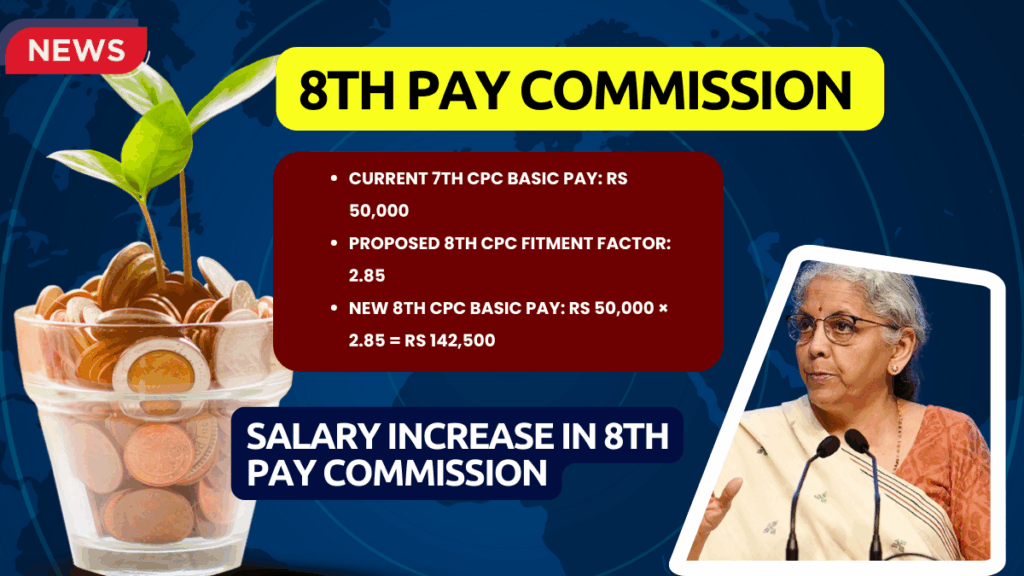

Current 7th CPC Basic Pay: Rs 50,000

Proposed 8th CPC Fitment Factor: 2.85

New 8th CPC Basic Pay: Rs 50,000 × 2.85 = Rs 142,500

This Direct Application Of The 2.85 Factor Results In A Significant Increase In Basic Pay, Specifically (142,500 – 50,000) / 50,000 = 185%. However, The Much-Talked-About “30% Salary Hike” Refers To The Overall Gross Salary Increase.

This 30% Projection Accounts For Not Just The Enhanced Basic Pay But Also Other Critical Components Of An Employee’s Total Emoluments. When Dearness Allowance (DA) Crosses The 50% Mark, Which Is Widely Anticipated By Early 2025, It Is Typically Merged With The Basic Pay, Effectively Becoming Part Of The New Base For Further Calculations.

Once The New, Higher Basic Pay (Derived From The 8th Pay Commission Factor And Potentially Consolidated With DA) Is Established, Allowances Like House Rent Allowance (HRA), Transport Allowance (TA), And Others Are Recalculated.

Since These Allowances Are Often A Percentage Of The Basic Pay, A Higher Basic Naturally Leads To Higher Allowances. The Combined Effect Of A Significantly Increased Basic Pay, Potential DA Merger, And Revised Allowances Is What Contributes To The Projected 30% Overall Hike In Gross Salary For Many Central Government Employees.

This Holistic View Provides A Clearer Picture Of How Much Salary Increase In 8th Pay Commission Can Be Expected.

To Get A More Personalized Estimate Of Your Potential Salary Increment, You Can Utilize An Online Calculator Tool. Such Tools Help Employees Input Their Current Basic Pay And Other Details To Compute Their Prospective New Salary Based On The Proposed 8th Pay Commission Salary Slab And Fitment Factor. It’s A Convenient Way To Visualize The Financial Changes Ahead.

Key Components of the 8th Pay Commission Salary Structure

Beyond The Basic Pay, A Central Government Employee’s Salary Comprises Several Other Crucial Components That Contribute To Their Gross Emoluments.

The 8th Pay Commission Factor Will Not Only Redefine The Basic Pay But Also Necessitate A Comprehensive Revision Of These Allowances, Thereby Shaping The Entire 8th Pay Commission Salary Structure Pdf That Will Eventually Be Released.

Dearness Allowance (DA): This Allowance Is Paid To Government Employees To Offset The Impact Of Inflation. It Is Revised Twice A Year, In January And July.

Key Expectation For The 8th Pay Commission Is The Potential Merger Of DA Into Basic Pay Once It Crosses A Certain Threshold, Typically 50%. Such A Merger Would Significantly Increase The Base For All Other Percentage-Based Allowances, Contributing Heavily To The Projected 30% Gross Salary Hike.

House Rent Allowance (HRA): HRA Varies Based On The Classification Of Cities (X, Y, Z Cities). With The Implementation Of The 8th Pay Commission, The HRA Rates Will Be Recalculated On The New, Higher Basic Pay.

This Means Employees In Metro Cities (X Category) Could See A Substantial Increase In Their HRA Component.

Transport Allowance (TA): Provided To Cover The Cost Of Commuting, TA Is Also Structured Based On Pay Levels And City Categories. Similar To HRA, The New 8th Pay Commission Factor Will Lead To Revised TA Rates, Reflecting The Enhanced Basic Pay.

Other Allowances: Various Other Allowances, Such As Medical Allowance, Children Education Allowance, Special Duty Allowance, And More, Are Also Subject To Review And Revision By The Pay Commission. The Overall Intent Is To Provide Adequate Compensation For Specific Needs And Responsibilities.

The New 8th Pay Commission Salary Slab Will Delineate Different Pay Levels And Their Corresponding Pay Matrices, Ensuring A Clear Progression Path For Employees.

Each Slab Will Have Distinct Entry Levels And Annual Increments, All Built Upon The Foundation Of The Revised Basic Pay.

Understanding These Components Is Essential For Employees To Fully Grasp The Potential Financial Upliftment From The Upcoming Commission.

Game-Changing 8th Pay Commission: If Your Basic Pay is ₹22,400, It Will Jump to ₹64,064 Overnight

Anticipated Timeline and the Road Ahead for 8th Pay Commission

The Formation And Implementation Of A New Pay Commission Is A Meticulous Process, Typically Involving Several Stages From Constitution To Final Disbursement.

While The Official Confirmation Is Awaited, Current Speculation, Fuelled By Economic Indicators And Government Employee Union Demands, Strongly Suggests That The 8th Pay Commission Date Could See Its Recommendations Taking Effect From January 2026.

Historically, Pay Commissions Are Constituted Approximately Every Ten Years. The 7th Pay Commission Was Implemented In 2016, Making 2026 A Logical Timeframe For The 8th. The Process Usually Involves:

Constitution Of The Commission: The Government Appoints A Committee Of Experts.

Study And Deliberation: The Commission Conducts Extensive Research, Gathers Representations From Various Employee Associations, And Analyzes Economic Data.

Submission Of Recommendations: A Detailed Report With Proposed Salary Structures, Allowances, And Other Benefits Is Submitted To The Government.

Government Review And Approval: The Government Scrutinizes The Recommendations, Often Engaging In Further Discussions, Before Approving And Notifying The Changes.

Implementation: The Revised Salaries And Allowances Are Then Implemented, Often With Retrospective Effect From The Designated 8th Pay Commission Date, Which In This Case Is Speculated To Be January 2026.

The Discussions Surrounding The 2.85 Fitment Factor And The Projected 30% Salary Hike Are Part Of The Ongoing Chatter In The Lead-Up To The Official Constitution Of The Commission. While These Figures Provide A Hopeful Outlook, It’s Important To Remember That They Remain Proposals Until Formally Adopted.

Employees Are Keenly Following The 8th Pay Commission Latest News For Any Official Announcements Regarding The Commission’s Formation And Its Mandate. Staying Informed Through Reliable Sources Will Be Crucial As We Approach The Anticipated 8th Pay Commission Latest News Today 2025 And Beyond.

8th Pay Commission Fitment Factor, Pay Matrix, Salary Structure & Hike

Calculate Your Potential Hike with an Online Tool

As The Prospect Of The 8th Pay Commission Draws Closer, Many Central Government Employees Are Eager To Estimate Their Potential New Salaries. While Official Figures And Final Recommendations Are Pending, An 8th Pay Commission Salary Calculator Can Be An Invaluable Resource.

These Online Tools Allow Users To Input Their Current Basic Pay, Existing Allowances, And Apply Hypothetical Fitment Factors And Allowance Rates.

By Doing So, Employees Can Get A Preliminary Estimate Of Their Increased Basic Pay And Overall Gross Salary, Helping Them Plan Their Finances Based On The Speculated Changes And The Likely Impact Of The 8th Pay Commission Factor. It Offers A Convenient Way To Compute Benefits Well In Advance.

Frequently Asked Questions about the 8th Pay Commission

What is the primary role of the 8th Pay Commission Factor?

The Primary Role Of The 8th Pay Commission Factor Is To Revise The Basic Pay And Overall Emoluments, Including Various Allowances, For Central Government Employees. Its Goal Is To Ensure That Salaries Remain Competitive And Commensurate With The Cost Of Living And Economic Conditions.

How much salary increase can I expect with the 8th Pay Commission?

While The Proposed 2.85 Fitment Factor Significantly Impacts The Basic Pay By Multiplying It, The Overall Gross Salary Hike Is Broadly Projected To Be Around 30%.

This Projection For How Much Salary Increase In 8th Pay Commission Takes Into Account Not Only The New Basic Pay But Also The Potential Merger Of Dearness Allowance (DA) And The Subsequent Revision Of Other Allowances Like HRA And TA, Which Will Be Calculated On The New, Higher Basic.

When is the 8th Pay Commission date expected to be implemented?

Based On Historical Patterns And Current Speculation, The 8th Pay Commission Date For Implementation Of Its Recommendations Is Widely Anticipated To Be From January 2026. Official Announcements Regarding The Commission’s Constitution And Timeline Are Still Awaited.

Will there be an 8th Pay Commission salary structure pdf available?

What is the primary role of the 8th Pay Commission Factor?

The Primary Role Of The 8th Pay Commission Factor Is To Revise The Basic Pay And Overall Emoluments, Including Various Allowances, For Central Government Employees. Its Goal Is To Ensure That Salaries Remain Competitive And Commensurate With The Cost Of Living And Economic Conditions.

How much salary increase can I expect with the 8th Pay Commission?

While The Proposed 2.85 Fitment Factor Significantly Impacts The Basic Pay By Multiplying It, The Overall Gross Salary Hike Is Broadly Projected To Be Around 30%.

This Projection For How Much Salary Increase In 8th Pay Commission Takes Into Account Not Only The New Basic Pay But Also The Potential Merger Of Dearness Allowance (DA) And The Subsequent Revision Of Other Allowances Like HRA And TA, Which Will Be Calculated On The New, Higher Basic.

When is the 8th Pay Commission date expected to be implemented?

Based On Historical Patterns And Current Speculation, The 8th Pay Commission Date For Implementation Of Its Recommendations Is Widely Anticipated To Be From January 2026. Official Announcements Regarding The Commission’s Constitution And Timeline Are Still Awaited.

Conclusion

The Prospect Of The 8th Pay Commission Factor Introducing A 2.85 Fitment Factor And Delivering A Potential 30% Salary Hike From January 2026 Represents A Significant And Welcome Development For Central Government Employees.

This Comprehensive Revision Aims To Align Salaries With Current Economic Realities, Offering Substantial Financial Relief And Enhanced Purchasing Power. While Official Announcements Are Still Pending, The Robust Discussions And Projections Provide A Hopeful Outlook.

Employees Are Encouraged To Stay Abreast Of The 8th Pay Commission Latest News And Developments To Fully Understand The Upcoming Changes And How Much Salary Increase In 8th Pay Commission They Can Anticipate, Ensuring They Are Well-Prepared For This Pivotal Shift In Their Remuneration Structure.