The anticipation surrounding the 8th Pay Commission Calculator is palpable among central government employees across India. With each passing year, the discussions intensify, focusing on potential salary revisions that could significantly impact financial well-being.

A critical element in these revisions is the fitment factor, a multiplier that transforms existing basic pay into a new, higher figure. This article delves into the intricacies of the 8th Pay Commission, exploring how a modest basic pay of ₹20,000 could potentially escalate to ₹57,200, offering a detailed breakdown of the calculations and the implications for a substantial salary increase.

Understanding this mechanism is key to appreciating the profound effect of the upcoming pay panel’s recommendations.

Understanding the 8th Pay Commission Landscape

The formation of a new 8th Pay Commission Calculator is a quadrennial event in India, typically occurring every ten years, designed to revise the salary structure and allowances for central government employees and pensioners.

Following the implementation of the 7th Pay Commission’s recommendations in 2016, discussions regarding the 8th Pay Commission are gaining traction. While no official 8th Pay Commission date has been announced, the general expectation aligns with the decadal cycle, leading many to anticipate its recommendations around 2026, with implementation potentially by 2027.

This makes the 8th Pay Commission Calculator latest news a subject of keen interest, particularly for those looking at the 8th pay commission latest news today 2025 updates.

The need for a new pay commission arises from various factors, including inflation, changes in cost of living, and the evolving economic landscape. Employees anticipate that the 8th Pay Commission will not only address these concerns but also streamline existing pay anomalies and introduce a more equitable compensation framework.

The previous pay commissions have historically led to significant adjustments, enhancing the purchasing power and living standards of government personnel. This systematic review ensures that government salaries remain competitive and fair, acknowledging the dedication and service of its workforce.

The Core of Salary Revision: Basic Pay and Fitment Factor

At the heart of any pay commission’s recommendations lies the revision of basic pay, which forms the foundation of an employee’s total salary. The most critical component in this revision process is the fitment factor.

Simply put, the fitment factor is a multiplier applied to an employee’s existing basic pay (often including grade pay if applicable from previous structures) to arrive at the new basic pay under the revised pay matrix.

For instance, the 7th Pay Commission adopted a uniform fitment factor of 2.57 for all employees. This meant that an employee’s basic pay in the 6th Pay Commission regime was multiplied by 2.57 to determine their new basic pay in the 7th Pay Commission.

The demand for a higher 8th Pay Commission Calculator fitment factor is a central plea from employee unions. While the 7th CPC used 2.57, many advocated for 3.68, arguing it was necessary to truly compensate for inflation and improve living standards.

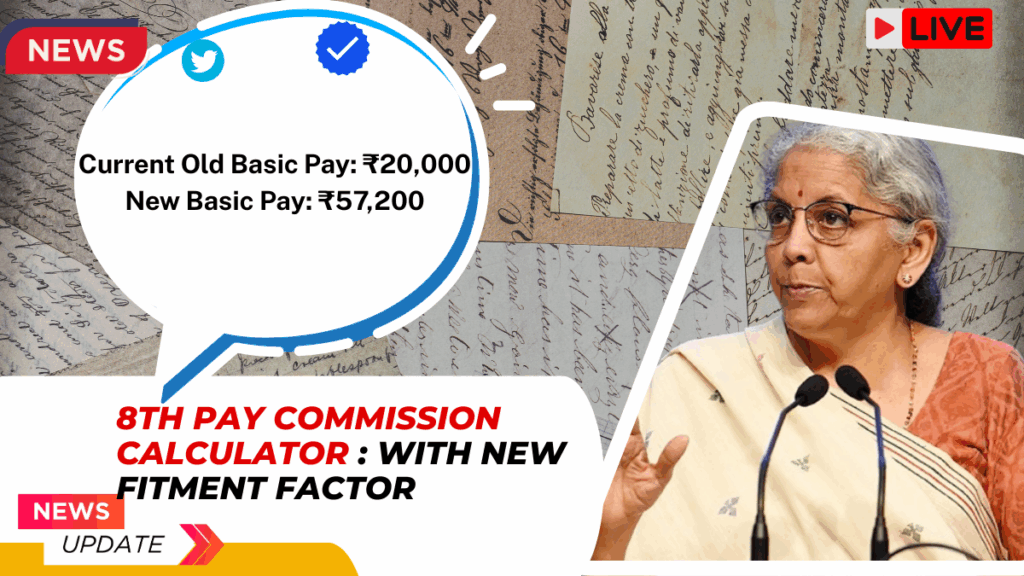

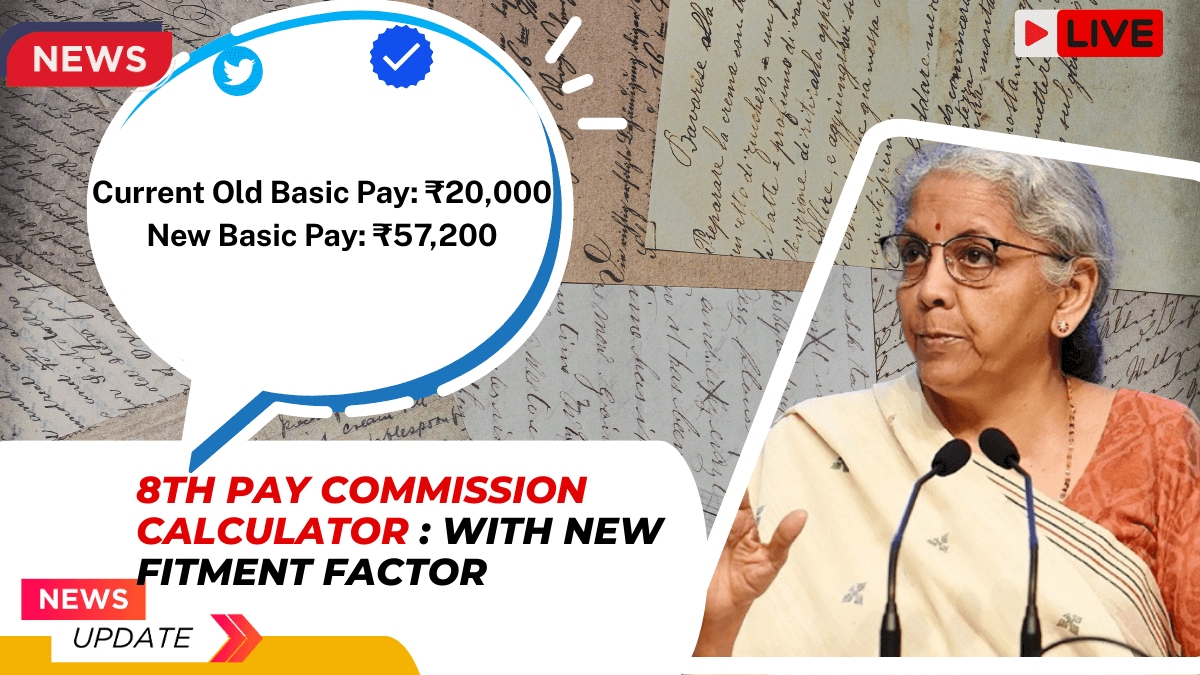

For our 8th Pay Commission example, to see a basic pay of ₹20,000 transform into ₹57,200, a fitment factor of 2.86 (₹57,200 / ₹20,000) would be necessary. This hypothetical 8th Pay Commission fitment factor of 2.86 serves as a plausible benchmark for understanding the potential leap in salaries.

This figure, though illustrative, demonstrates how a significant fitment factor is the primary driver behind substantial basic pay hikes, impacting every subsequent component of the salary.

Dissecting the Salary Structure: Components Beyond Basic Pay 8th Pay Commission Calculator

While the fitment factor dramatically alters the basic pay, the overall salary structure is a mosaic of various components, each contributing to the gross and net take-home.

Beyond basic pay, the major allowances include Dearness Allowance (DA), House Rent Allowance (HRA), Transport Allowance (TA), and various other special allowances.

Each of these is directly or indirectly linked to the basic pay, meaning an increase in basic pay due to the8th Pay Commission Calculator example has a cascading effect on the entire salary.

* Dearness Allowance (DA): This allowance is provided to employees and pensioners to offset the impact of inflation. It is revised periodically (usually semi-annually) and calculated as a percentage of the basic pay. A higher basic pay automatically translates into a higher DA.

* House Rent Allowance (HRA): HRA varies based on the class of city (X, Y, or Z) an employee resides in and is calculated as a percentage of basic pay (e.g., 27%, 18%, 9%). An increased basic pay will lead to a higher HRA, significantly benefiting employees, especially in metro cities.

* Transport Allowance (TA): This allowance covers commuting expenses and also varies based on pay level and city category. It often comprises a fixed amount plus DA calculated on that fixed amount.

* Other Allowances: These can include special duty allowance, children’s education allowance, medical allowance, and more, all of which may be revised or linked to the new basic pay structure.

For those anticipating the 8th Pay Commission Calculator salary structure pdf, understanding how these components interact is crucial. To simplify these complex calculations and get a precise estimate, an 8th Pay Commission Calculator online calculator tool can be incredibly beneficial.

Such tools allow employees to input their current basic pay and a hypothetical fitment factor to project their new basic pay and subsequent allowances, offering a clear picture of how much salary increase in 8th Pay Commission they might expect.

A Practical Calculation: From ₹20,000 to ₹57,200 and Beyond

Let’s illustrate the transformation of a ₹20,000 basic pay with a new, hypothetical 8th Pay Commission fitment factor of 2.86, as envisioned in our8th Pay Commission Calculator example.

**Scenario 1: Current Salary (Pre-8th Pay Commission, illustrative with 7th CPC rates)**

Assuming an employee currently has a basic pay of ₹20,000 from the 7th CPC matrix.

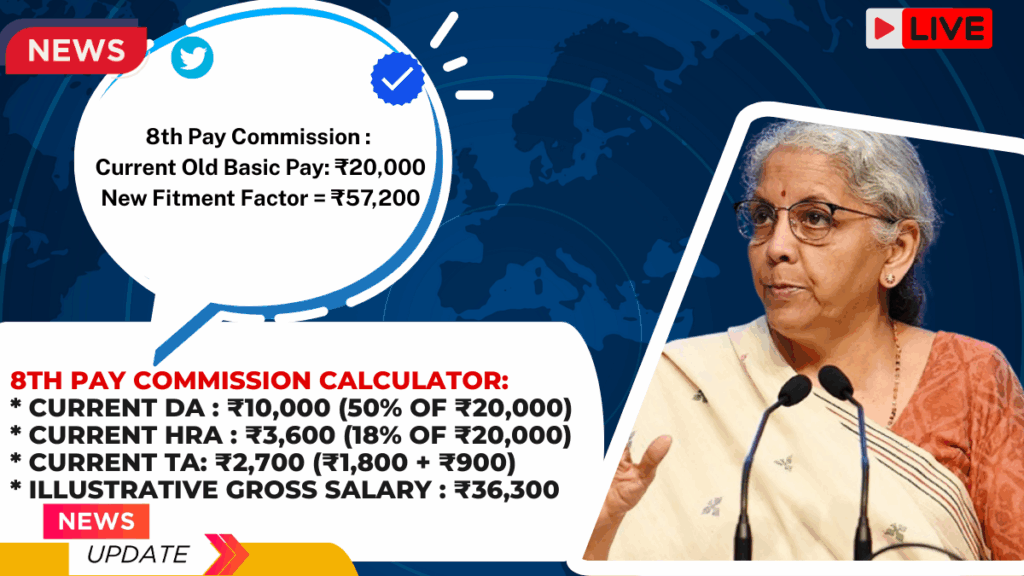

* Current Basic Pay: ₹20,000

* Current DA (e.g., 50% of Basic): ₹10,000 (50% of ₹20,000)

* Current HRA (e.g., 18% for Y-class city): ₹3,600 (18% of ₹20,000)

* Current TA (e.g., ₹1,800 + 50% DA on TA): ₹2,700 (₹1,800 + ₹900)

* Illustrative Gross Salary (Current): ₹20,000 + ₹10,000 + ₹3,600 + ₹2,700 = ₹36,300

**Scenario 2: Proposed Salary (Post-8th Pay Commission, illustrative with 2.86 Fitment Factor)**

With the advent of the 8th Pay Commission, let’s apply our hypothetical fitment factor of 2.86.

* New Basic Pay: ₹20,000 (Old Basic) × 2.86 (New Fitment Factor) = ₹57,200

Now, calculating other allowances based on this new basic pay, assuming revised but similar percentage structures (DA is often reset to 0% with a new commission, but for comprehensive illustration, we assume an initial post-commission DA):

* New Basic Pay: ₹57,200

* Estimated New DA (e.g., 10% post-commission): ₹5,720 (10% of ₹57,200)

* Estimated New HRA (e.g., 18% for Y-class city): ₹10,296 (18% of ₹57,200)

* Estimated New TA (e.g., revised to ₹3,600 + 10% DA on TA): ₹3,960 (₹3,600 + ₹360)

* Illustrative Gross Salary (New): ₹57,200 + ₹5,720 + ₹10,296 + ₹3,960 = ₹77,176

This example vividly demonstrates how the new 8th Pay Commission Calculator fitment factor of 2.86 can dramatically increase an employee’s basic pay from ₹20,000 to ₹57,200, leading to a much higher gross salary. Such a rise profoundly impacts an employee’s financial planning, savings, and overall quality of life.

The 8th Pay Commission salary slab structure is expected to rationalize pay at various levels, ensuring a fair progression for all government employees. To accurately compute benefits and future earnings, employees often rely on dedicated online tools.

These tools are invaluable for projecting the personal impact of the 8th Pay Commission Calculator recommendations, including how much salary increase in 8th Pay Commission they might receive.

Frequently Asked Questions

When is the 8th Pay Commission date expected?

While no official 8th Pay Commission date has been announced, it is generally anticipated that the commission will be constituted around 2024-2025, with recommendations and implementation likely by 2026-2027, following the decadal pattern of previous pay commissions. Updates on the 8th pay commission latest news today 2025 are keenly awaited by employees.

What is the expected 8th Pay Commission fitment factor?

The 8th Pay Commission Calculator fitment factor is a key point of discussion. While the 7th Pay Commission used 2.57, employee unions often demand a higher factor, such as 3.68, to account for inflation. For our 8th Pay Commission example, a factor of 2.86 was used to illustrate a specific salary increase from ₹20,000 to ₹57,200, demonstrating how much salary increase in 8th Pay Commission is possible with a robust fitment factor.

Where can I find the 8th Pay Commission salary structure pdf?

An official 8th Pay Commission Calculator salary structure pdf will only be released once the commission is formed, conducts its study, and submits its recommendations, which are then approved by the government. Until then, any documents available are speculative. Information regarding the 8th Pay Commission salary slab will be detailed in this official report.

How does the 8th Pay Commission example impact my current basic pay of ₹20,000?

As per our 8th Pay Commission example, if the commission recommends a fitment factor of 2.86, your current basic pay of ₹20,000 would become ₹57,200. This increase in basic pay would then proportionally raise your Dearness Allowance, House Rent Allowance, and other allowances, leading to a significantly higher gross salary. Using an 8th Pay Commission salary calculator can help you estimate your specific increase.

Conclusion

The prospect of the 8th Pay Commission Calculator brings with it immense hope and anticipation for central government employees. As demonstrated through our 8th Pay Commission example, the impact of a revised fitment factor on basic pay can be transformative.

The journey from a ₹20,000 basic pay to a potential ₹57,200, driven by a hypothetical fitment factor of 2.86, highlights the profound financial implications of the upcoming recommendations.

Beyond the basic pay, the ripple effect on various allowances like DA, HRA, and TA means a substantial boost to the overall take-home salary. While details of the 8th Pay Commission Calculator salary calculator and the final fitment factor are yet to be revealed, the potential for enhanced financial stability and improved living standards remains a central theme, eagerly awaited by millions.

Leave a Reply