Embarking on a journey towards financial independence requires smart, strategic investment choices. For many Indians, the Public Provident Fund (PPF) stands out as a reliable and government-backed avenue for long-term wealth creation. Specifically, the Post Office PPF Scheme offers unparalleled security combined with attractive tax benefits and a robust return potential.

Imagine channeling just ₹6,000 monthly into an investment that could grow to over ₹20 Lakhs in 15 years, with the possibility of reaching ₹24+ Lakh and beyond, all while enjoying tax-free returns at a current rate of 7.1%. This comprehensive guide will delve into how the Post PPF Scheme works, its advantages, and how you can harness its power to build substantial tax-free wealth for your future.

Understanding the Post PPF Scheme: A Foundation for Secure Wealth Creation

The Public Provident Fund (PPF) is a popular long-term savings cum investment scheme in India, primarily known for its tax-saving benefits and risk-free nature. When operated through the Post Office, the Post PPF Scheme gains an added layer of accessibility and trust, leveraging the vast network of India Post. Introduced in 1968, it aims to provide a retirement corpus for individuals, making it an excellent tool for disciplined savings over an extended period.

A key attraction of the Post PPF Scheme is its government backing, meaning the capital invested and the interest earned are entirely secure. This makes it a preferred choice for conservative investors seeking guaranteed returns without market volatility risks.

The scheme offers a fixed tenure of 15 years, during which contributions can be made annually, biannually, or monthly. The minimum annual contribution is ₹500, and the maximum is ₹1.5 lakh. This limit applies across all PPF accounts held by an individual (including those opened at banks).

The Post office ppf interest rate, currently at 7.1% (subject to quarterly revision by the government), is one of the most competitive for a sovereign-backed instrument.

This interest is compounded annually, allowing your money to grow exponentially over time. Importantly, the entire investment process, from opening an account to making deposits and eventual withdrawal, is streamlined through Post Office branches across the country, ensuring ease of access for millions.

The Power of Compounding: Turning ₹6,000 Monthly into ₹20+ Lakhs (and Beyond)

The true magic of the Post PPF Scheme lies in the power of compounding. Let’s break down the promise of turning a regular investment into a substantial corpus.

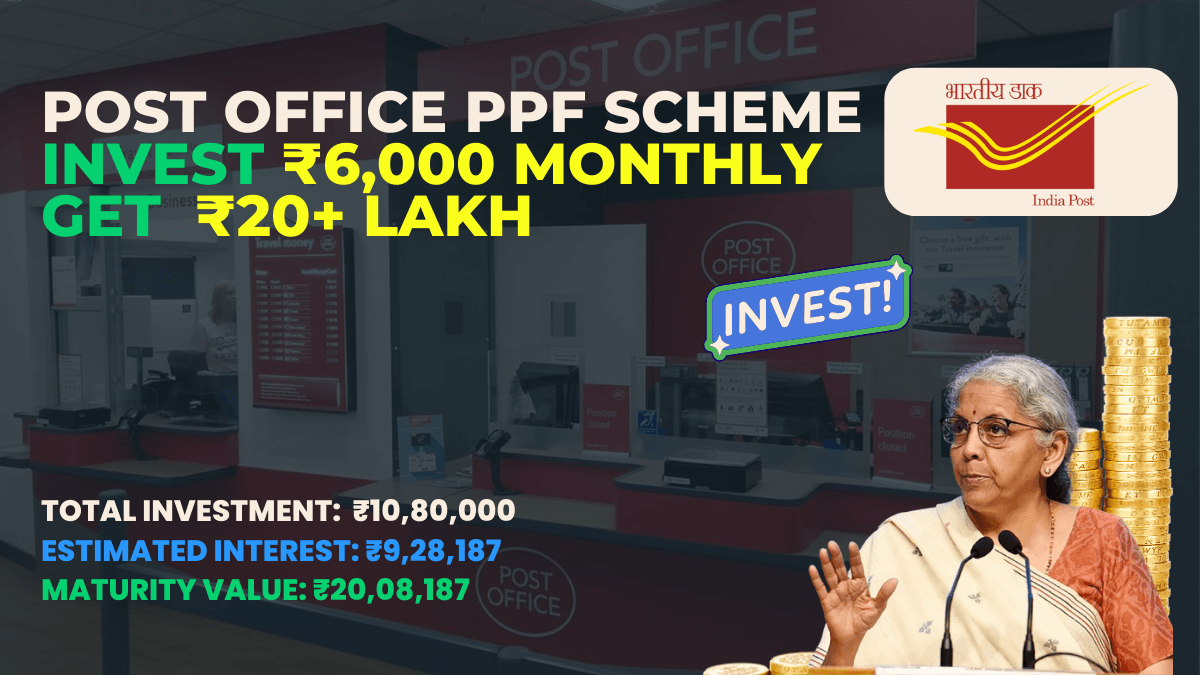

If you commit to investing ₹6,000 monthly, which translates to ₹72,000 annually, for the full 15-year tenure of the `Post Office PPF scheme 15 years`, at the current Post office ppf interest rate of 7.1% per annum, your investment journey would look like this:

* Total Investment over 15 years: ₹6,000/month x 12 months x 15 years = ₹10,80,000

* Estimated Interest Earned: Approximately ₹9,28,187

* Maturity Value after 15 years: Approximately ₹20,08,187

This calculation clearly shows how a disciplined ₹6,000 monthly contribution can grow your initial investment of ₹10.8 Lakhs into over ₹20 Lakhs, purely through the effect of compounding interest. To visualize this growth and plan effectively, a reliable Post office ppf calculator is an indispensable tool. You can use an online calculator tool to project your returns precisely.

Post Office NSC 2025: Turn ₹5 Lakh Into ₹7.24 Lakh with 7.7% Tax-Saving Returns

Now, regarding the title’s promise of reaching ₹24+ Lakh: While ₹6,000 monthly for 15 years at 7.1% yields approximately ₹20.08 Lakh, achieving ₹24+ Lakh is certainly within reach with minor adjustments. Here are two primary ways:

1. Slightly Increased Monthly Contribution: By increasing your monthly contribution by a modest amount, for example, to approximately ₹7,200-₹7,500 (around ₹90,000 annually), you could reach the ₹24 Lakh mark within the same 15-year period.

2. Extension of Tenure: The Post PPF Scheme allows you to extend the `Post Office PPF scheme 15 years` tenure in blocks of 5 years. By extending your investment for just one additional 5-year block (making it a total of 20 years), even with the original ₹6,000 monthly contribution, your corpus would comfortably cross ₹31 Lakhs, far surpassing the ₹24 Lakh goal. This flexibility makes the Post PPF Scheme an even more powerful wealth-building instrument for long-term financial planning.

Using a `Post Office PPF scheme 15 years Calculator` will help you model these scenarios and understand the exact impact of changing your investment amount or tenure.

Maximizing Your Returns: Strategies and Features of the Post Office PPF

Beyond the basic calculations, understanding the nuances of the Post PPF Scheme can significantly enhance your returns and overall financial planning.

Strategic Investment for Maximum Interest

To maximize the interest earned, it’s crucial to make your monthly contributions before the 5th of each month. PPF interest is calculated on the lowest balance between the 5th and the last day of the month. By depositing early, you ensure your contribution earns interest for the entire month.

This small habit can add up to significant extra earnings over the `Post Office PPF scheme 15 years`. The `Post Office PPF scheme 15 years interest rate` applied consistently ensures steady growth.

Unmatched Tax Benefits: The EEE Advantage

The Post PPF Scheme is celebrated for its ‘Exempt, Exempt, Exempt’ (EEE) tax status, making it one of the most tax-efficient investment vehicles in India:

* Exempt (E1): Contributions up to ₹1.5 lakh per financial year are eligible for deduction under Section 80C of the Income Tax Act.

* Exempt (E2): The interest earned on your PPF account is entirely tax-free.

* Exempt (E3): The maturity amount, including both principal and accumulated interest, is also fully exempt from tax.

This EEE status means your wealth grows untouched by taxes at every stage, offering a significant advantage over other investment options.

Flexibility and Liquidity: Loans and Partial Withdrawals

While a long-term scheme, the Post PPF Scheme offers some liquidity options:

* Loan Facility: You can avail a loan against your PPF balance from the 3rd financial year up to the 6th financial year. The maximum loan amount is 25% of the balance at the end of the second year preceding the year in which the loan is applied.

* Partial Withdrawal: After the expiry of five financial years from the end of the year in which the account was opened, you are eligible for partial `Post office ppf withdrawal`.

The maximum withdrawal is 50% of the balance at the end of the fourth year preceding the year of withdrawal or 50% of the balance at the end of the preceding year, whichever is lower. These options provide a safety net while maintaining the long-term integrity of your investment.

Extending Your Wealth Journey: Beyond 15 Years

Upon completing the `Post Office PPF scheme 15 years` tenure, you have three choices:

1. Withdraw the entire maturity amount: The entire corpus, being tax-free, can be withdrawn.

2. Extend the account without fresh contributions: Your account continues to earn the prevailing Post office ppf interest rate, but you cannot make new deposits. This is ideal if you don’t need the money immediately and want it to continue growing tax-free.

3. Extend the account with fresh contributions: This is a popular option for continued wealth building. You can extend your PPF account in blocks of 5 years, continuing to make contributions (up to ₹1.5 lakh annually) and enjoying all the benefits, including tax-free interest and maturity.

This is the pathway to significantly exceeding the ₹24 Lakh target, transforming your `Post PPF Scheme` into a truly generational wealth tool.

Essential Tools for PPF Planning and Management

Effective financial planning relies heavily on accurate projections. When it comes to the Post PPF Scheme, various calculation tools can be immensely helpful. A `Post office ppf calculator` is an indispensable resource for anyone considering this investment.

These online tools allow you to input your monthly or annual investment amount, the current Post office ppf interest rate, and your desired tenure to instantly compute your estimated maturity amount.

For instance, if you’re exploring the impact of extending your investment beyond the standard 15 years, a `Post Office PPF scheme 15 years Calculator` can illustrate how quickly your corpus grows. While generic online calculators are widely available, some investors might prefer using a `Post Office PPF scheme 15 years calculator SBI` for familiar banking interface or a `Post Office PPF scheme 15 years Calculator Excel` for more personalized, detailed scenario analysis. These tools empower you to:

* Set Realistic Goals: Understand what investment amount and tenure are required to meet your specific financial objectives, such as retirement planning or funding a child’s education.

* Compare Scenarios: Evaluate the impact of increasing or decreasing your monthly contributions, or extending the scheme for different periods.

* Track Progress: Though not real-time, these calculators give you a clear roadmap of your expected growth, motivating consistent investment.

Using a reliable online calculator tool not only simplifies complex financial computations but also helps in making informed decisions about your `Post PPF Scheme` investment. A free calculator can help you compute benefits of various investment strategies within the PPF framework.

Frequently Asked Questions about Post Office PPF Scheme

Q1: What is the current Post office ppf interest rate?

The interest rate for the Post Office PPF Scheme is currently 7.1% per annum, compounded annually. This rate is reviewed quarterly by the Ministry of Finance and is subject to change.

Q2: Can I withdraw money before Post Office PPF scheme 15 years maturity?

Yes, you can make a partial `Post office ppf withdrawal` after the expiry of five financial years from the end of the year in which the account was opened. Full premature closure is allowed only under specific circumstances like treatment of life-threatening diseases or higher education, with a 1% interest rate reduction.

Q3: How does the Post PPF Scheme offer tax-free returns?

The Post PPF Scheme follows an ‘Exempt, Exempt, Exempt’ (EEE) taxation model. This means your contributions are tax-deductible under Section 80C, the interest earned is tax-free, and the maturity amount is also entirely exempt from income tax.

Q4: How can a Post office ppf calculator help me plan my investment?

A Post office ppf calculator allows you to input your desired monthly/annual investment, the interest rate, and the tenure to instantly estimate your maturity amount. This helps you visualize the growth of your funds, set realistic financial goals, and compare different investment scenarios for the `Post PPF Scheme`.

Conclusion

The Post PPF Scheme stands as a cornerstone of secure and tax-efficient long-term financial planning in India. By committing a disciplined ₹6,000 monthly, you can confidently aim for a substantial corpus of over ₹20 Lakhs in 15 years, with strategic extensions and slightly higher contributions paving the way to easily surpass ₹24 Lakh.

Its government backing ensures capital safety, while the current 7.1% Post office ppf interest rate and EEE tax benefits make it a compelling choice for wealth creation. Utilizing a Post office ppf calculator is vital for effective planning, allowing you to project growth and make informed decisions. Embracing the `Post PPF Scheme` is not just about saving; it’s about strategically investing in a secure, tax-free future for yourself and your loved ones, leveraging the power of compounding for significant returns.

Leave a Reply